Part time salary tax calculator

See where that hard-earned money goes - Federal Income Tax Social Security. The percentage depends on your income.

Payroll Tax Calculator For Employers Gusto

So a freelancer with a day rate of 150 would have a pro rata salary of 39000.

. If your part-time income from employment was 15000. Use New Zealands best income tax calculator to work out how much money you will take home after taxes. Part-time income tax calculator.

OLPMS - Instant Payroll Calculator. Income Tax Rate ranges from 5 to 45. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations.

You can change the calculation by saving a new Main income. Related Take Home Pay. Your employer uses the information that you provided on your W-4 form to.

Federal income taxes are also withheld from each of your paychecks. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Piscataway is located within Middlesex.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. This includes the rates on the state county city and special levels. The unadjusted results ignore the holidays and paid vacation days.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The payment for the. Apply to Tax Preparer Staff Accountant Accountant and more35 Accountant Part Time jobs available.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. The average cumulative sales tax rate in Piscataway New Jersey is 663. If you are changing to part-time work or are considering a job where the salary is worked out pro-rata use the pro-rata Salary Calculator to see how.

Posted on January 31 2022. To stop the auto-calculation you will need to delete. Simply enter your salary or hourly wage and let our calculator do the rest.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. If the part-time income exceeds these amounts you will have to declare the excess in your tax return. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

If you are a New York State part-year resident you must file Form IT-203 Nonresident and Part-Year Resident Income Tax Return if you meet any of the following. Your average tax rate. How to calculate Australian goods and services tax.

Input salary benefits provide your full-time weekly monthly or annual salary holiday entitlement and the percentage you contribute to your pension. That means that your net pay will be 40568 per year or 3381 per month. SSN Week Ending mmddyyyy Salary Information.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Discover Helpful Information And Resources On Taxes From AARP. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

How Your New Jersey Paycheck Works. Sacrificing part of your salary can reduce your tax. Up next in Income tax.

It can also be used to help fill steps 3 and 4 of a W-4 form. Input the date of you last pay rise when your current pay was set and find out where your current salary has. Try out the take-home calculator choose the 202223 tax year and see how it affects.

So normal part-timers dont need to pay income tax if annual income is less than 1030000 yen while 1300000 yen for part-time working students. The PAYE Calculator will auto calculate your saved Main gross salary. Use this calculator to see how inflation will change your pay in real terms.

Pro-Rata Furlough Tax Calculator.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

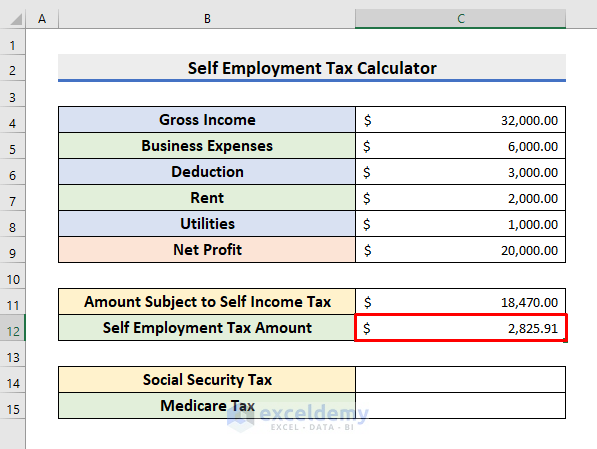

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

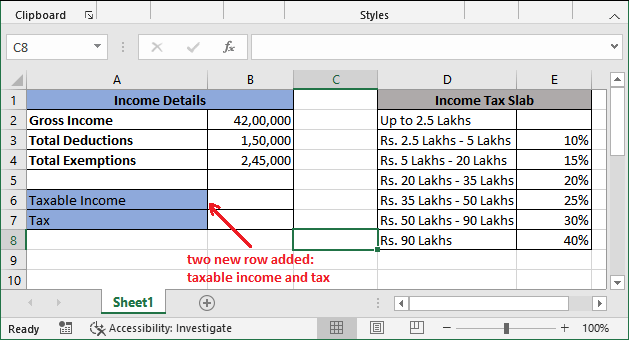

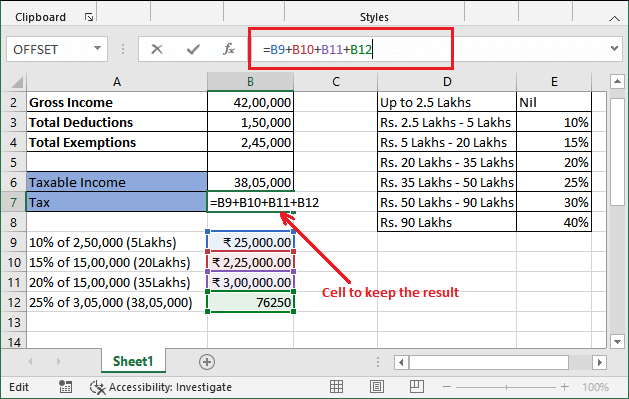

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Example

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Income Tax Calculating Formula In Excel Javatpoint

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Effective Tax Rate Formula Calculator Excel Template

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Formula Excel University